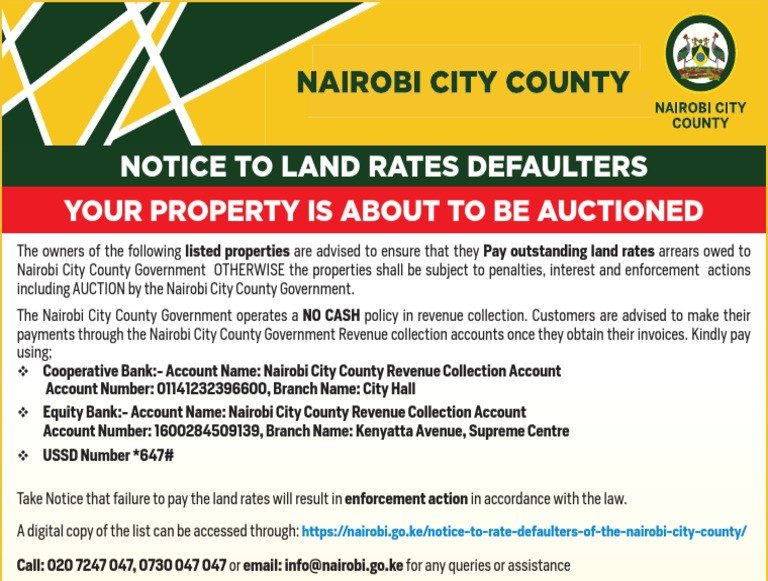

Our firm recently advised the United Nations Federal Credit Union on the implications ofnotices issued by Nairobi City County threatening auction of properties over unpaid landrates. The key legal question was whether the County could enforce payment throughauction where the property is already charged to a third party.

The answer lies in Section 19 of the Rating Act, which allows county governments toregister a statutory charge for unpaid land rates—such charge taking priority over all otherencumbrances. Section 28(g) of the Land Registration Act confirms this priority status byclassifying such charges as overriding interests.

However, the County must follow due process:

- Issue formal demands and notices under Section 17 of the Rating Act;

- Allow the property owner an opportunity to pay or object;

- Seek court orders before enforcing sale under Section 96 and 101 of the Land Act;

- Serve notices on all interested parties, including lenders and chargees.

The courts have consistently upheld this enforcement framework in cases like Mwai Ltd v. Municipal Council of Mombasa and Dileep Patel v. Municipal Council of Nakuru.

For lenders and financiers, this highlights the importance of:

- Insisting on land rate clearance certificates before advancing loans;

- Registering charges properly to receive notices under Section 96(3) of the Land Act;

- Monitoring compliance by borrowers to avoid risk of enforcement by rating authorities.

While the County’s right to recover rates is constitutionally and statutorily grounded, it

must be exercised fairly, transparently, and in strict conformity with the law.